child tax credit 2021 dates

Find COVID-19 Vaccine. The advanced Child tax credit payments are scheduled to end on December 15 2021.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit.

. New 2021 Child Tax Credit and advance payment details. We dont make judgments or prescribe specific policies. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Learn more about the Advance Child Tax Credit. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return. That means parents. The payment for children.

See what makes us different. The 500 nonrefundable Credit for Other Dependents amount has not changed. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit. The IRS will make a one-time payment of 500 for dependents age.

For more information see Q B7 in Topic B. Your amount changes based on the age of your children. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

These are the dates the IRS plans to send payments by. Half of the total will be paid as six monthly payments and half as a 2021 tax credit. 3600 for children ages 5 and under at the end of 2021.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. The IRS said. Get your advance payments total and number of qualifying children in your online account.

Jun 10 2021 0600 AM CDT. This first batch of advance monthly payments worth. Ad File a free federal return now to claim your child tax credit.

Frequently asked questions about the Advance Child Tax Credit Payments in 2021 Topic A. IR-2021-153 July 15 2021. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return.

Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the holidays. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Jun 10 2021.

Child Tax Credit 2021. Final date to update information on Child Tax Credit Update Portal to impact advance Child Tax Credit payments disbursed in December. The new advance Child Tax Credit is based on your previously filed tax return.

Child Tax Credit amounts will be different for each family. 3000 for children ages 6 through 17 at the end of 2021. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Child tax credit checks. The IRS will send out the next round of child tax credit payments on October 15. Here are the child tax benefit pay dates for 2022.

When is the deadline to opt out from August payment. These changes apply to tax year 2021 only The federal body said the. Part of the American Rescue Plan eligible parents can get half of their allowance before the end of 2021 and the.

When you file your 2021 tax return you can claim the other half of the total CTC. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. By August 2 for the August.

The final payment of the 2021 child tax credit is scheduled to be deposited into bank accounts on December 15. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. While not everyone took advantage of the payments which started in July 2021 and.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Enter your information on Schedule 8812 Form. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

To reconcile advance payments on your 2021 return. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000.

Canada Child Benefit Ccb Payment Dates Application 2022

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

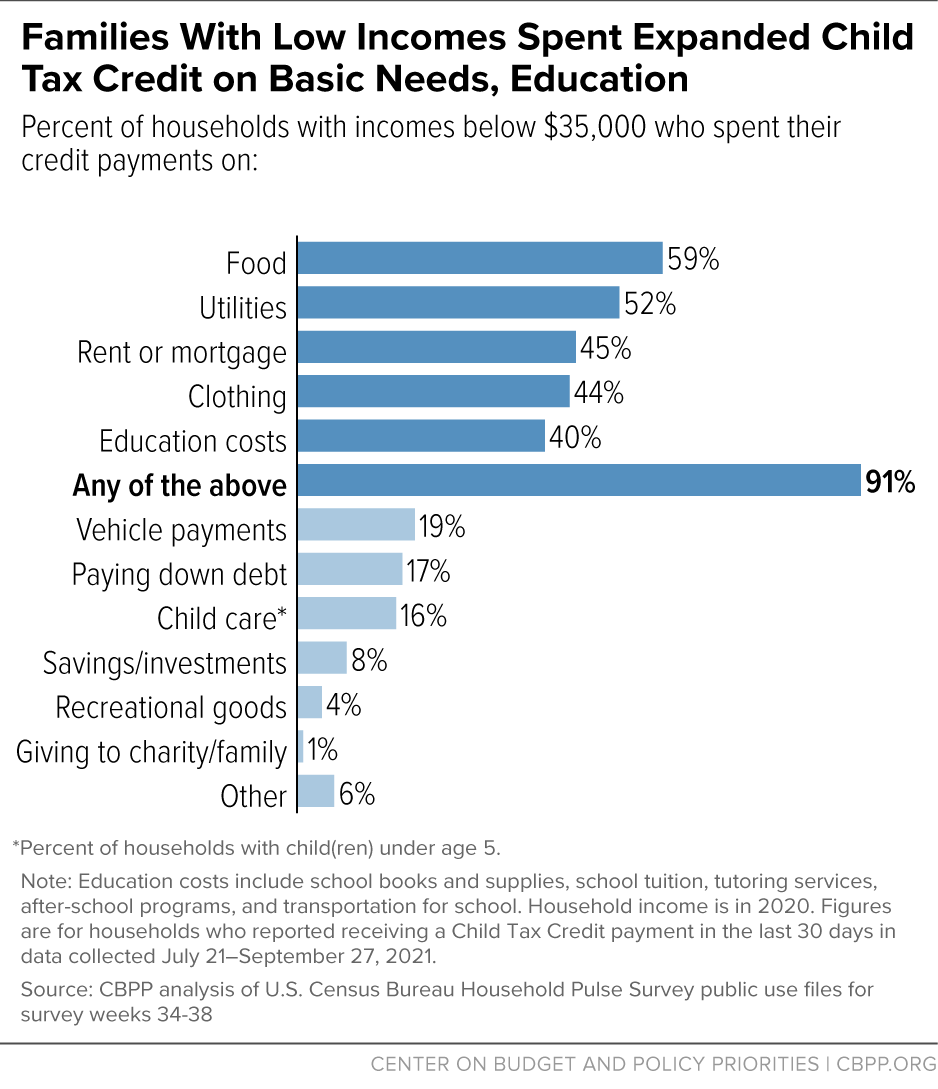

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Electric Vehicle Tax Credit Guide Car And Driver

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Childctc The Child Tax Credit The White House

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Tax Credit Definition How To Claim It

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities